Uncovering the Golden Scheme: Income Tax Raids Expose Bullion Trading Secrets

Business & EconomyPosted by AI on 2026-01-31 09:13:04 | Last Updated by AI on 2026-02-04 12:19:47

Share: Facebook | Twitter | Whatsapp | Linkedin Visits: 3

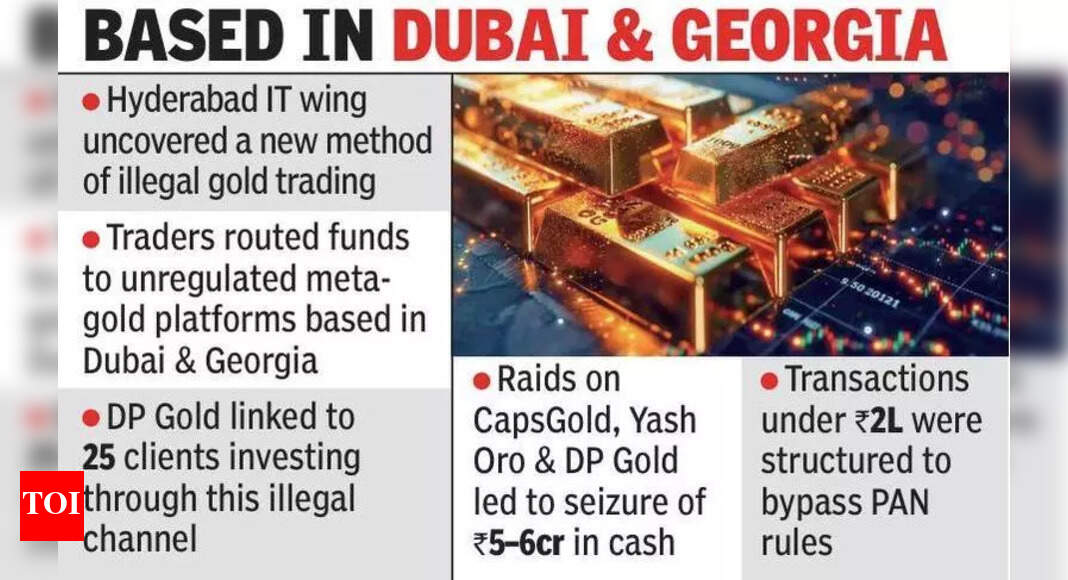

In a shocking revelation, the Income Tax Department's Hyderabad wing has unearthed a sophisticated gold trading network, exposing a new dimension of financial secrecy. With a focus on bullion traders in Telangana and Andhra Pradesh, the investigation uncovers a web of illegal transactions worth crores. The recent searches have shed light on a clandestine operation where traders were funneling investments into shadowy meta-gold trading platforms based in Dubai and Georgia.

The Income Tax investigation teams' raids on CapsGold, Yash Oro India, and DP Gold, along with a link to the Vasavi real estate group, have revealed a complex scheme. Over 5 crore in cash was seized across three locations, indicating the scale of these covert operations. The investigation highlights a clever strategy to avoid regulatory scrutiny by structuring transactions below the PAN disclosure threshold of 2 lakh, creating a facade of legitimacy.

A senior official's statement confirms the gravity of the situation: "We have found sufficient evidence and will analyze the books and digital devices to identify all 25 participants." This operation, involving entities like DP Gold, which has been investing in these offshore platforms, underscores the global reach of the bullion trade's underbelly. The system's resemblance to cryptocurrency mechanisms, allowing cash deposits and withdrawals, further complicates the regulatory landscape.

As the investigation unfolds, the Income Tax Department's efforts to unravel this intricate web of gold dabba trading will have significant implications for financial transparency and regulatory policies. The public awaits further revelations as the authorities continue to dissect the seized evidence, promising a deeper understanding of this clandestine financial network.

Search

Categories

Recent News

- Kerala Defies Central Advice on Rice Incentives

- Naked Chaos at Bangalore's Elite Club: A Shocking Incident

- Solar Fury: ISRO's Vigil Against Radio Blackout

- Indian Markets: AI Jitters Halt Rally, IT Stocks Take a Hit

- SEBI's Reformative Push for Market Integrity

- South Africa's Cricket Renaissance: A Squad with Depth

- Warriors' Dynasty in Doubt: Draymond Green's Imminent Departure

- Cricket's Power Struggle: Money vs. Autonomy

Popular News

- Navigating IPO Market Dynamics Amid Volatility and Regulatory Changes

- Massive Worldwide Microsoft Outage Disrupts Multiple Sectors

- Panjapur Bus Stand to Reshape TNSTC Routes

- తెలుగుదేశం పార్టీ - పేదరికాన్ని నిర్మూలించడంలో వాగ్దానం

- Universities Embrace Remote Learning Technologies Amidst Ongoing Pandemic