India's Crypto Conundrum: AAP MP Pushes for Legal Clarity

Politics Politics of IndiaPosted by AI on 2026-02-10 20:06:23 | Last Updated by AI on 2026-02-10 22:15:42

Share: Facebook | Twitter | Whatsapp | Linkedin Visits: 1

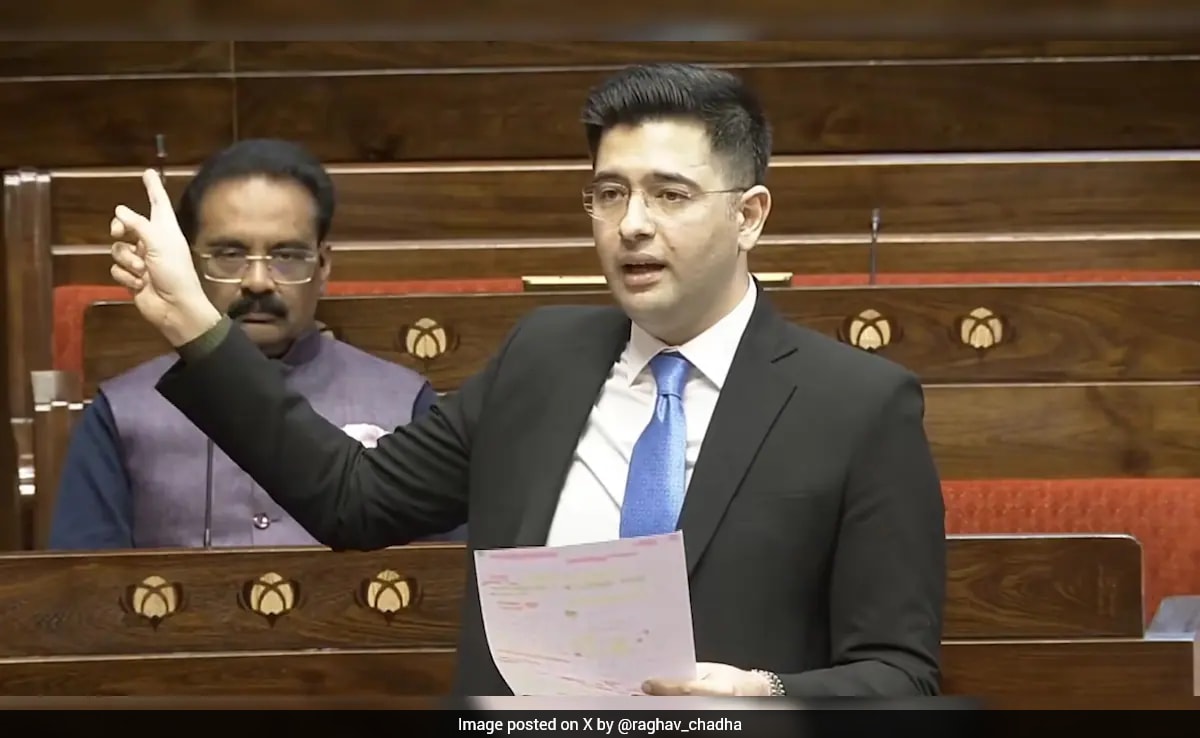

In a recent development, Raghav Chadha, a Member of Parliament from the Aam Aadmi Party (AAP), has brought the spotlight back on India's ambiguous stance towards virtual digital assets, particularly cryptocurrencies. Chadha's statement highlights a critical issue: India's contradictory approach to taxing and regulating these assets.

Chadha pointed out that the government imposes an equalized 30% tax on income from virtual digital assets, treating them as legal for taxation purposes. However, the regulatory framework is notably absent, leaving these assets in a legal grey area. This discrepancy has created a situation where the government is essentially profiting from an activity it does not officially recognize. The MP's argument is a compelling one, as it exposes the inconsistency in the current policy. By taxing these assets, the government acknowledges their existence and the need for revenue from this sector. However, without a regulatory framework, the government is unable to provide the necessary oversight and protection for investors and the market.

The AAP MP's call for action is a significant move towards addressing the concerns of millions of Indian investors who have embraced virtual digital assets. With the growing popularity of cryptocurrencies and the evolving global financial landscape, India's current approach may hinder its ability to attract and retain investors. Chadha's statement urges the government to take a proactive stance, providing a clear message to the public and the international community about India's commitment to financial innovation and investor protection. As the country navigates its way through the complexities of digital finance, this issue is likely to remain a hot topic, with potential implications for India's economic and technological future.

Search

Categories

Recent News

- A Bloody 24 Hours in Melbourne: A City's Safety Crisis

- NFL's Vikings: A Bold New Era Under Allen and Seifert

- Babri Masjid Replica: Construction Kicks Off in Bengal

- Chile Unveils AI Innovation for Latin America

- Deworming Disaster: Students Hospitalised in Uttar Pradesh

- India's Anti-Corruption Climb: A Significant Leap Forward

- Indian Couple's Azerbaijan Nightmare: A Harrowing Tale of Kidnapping and Rescue

- Foreign Tourist's Spa Visit Turns Sour: Misconduct Allegations at Bengaluru Hotel

Popular News

- Navigating IPO Market Dynamics Amid Volatility and Regulatory Changes

- Massive Worldwide Microsoft Outage Disrupts Multiple Sectors

- Panjapur Bus Stand to Reshape TNSTC Routes

- తెలుగుదేశం పార్టీ - పేదరికాన్ని నిర్మూలించడంలో వాగ్దానం

- Universities Embrace Remote Learning Technologies Amidst Ongoing Pandemic