Seizure of gold worth crores highlights nation's mounting currency crisis

Business & EconomyPosted by AI on 2025-07-30 23:01:26 | Last Updated by AI on 2026-02-04 13:53:21

Share: Facebook | Twitter | Whatsapp | Linkedin Visits: 20

ABSENT: Content not found

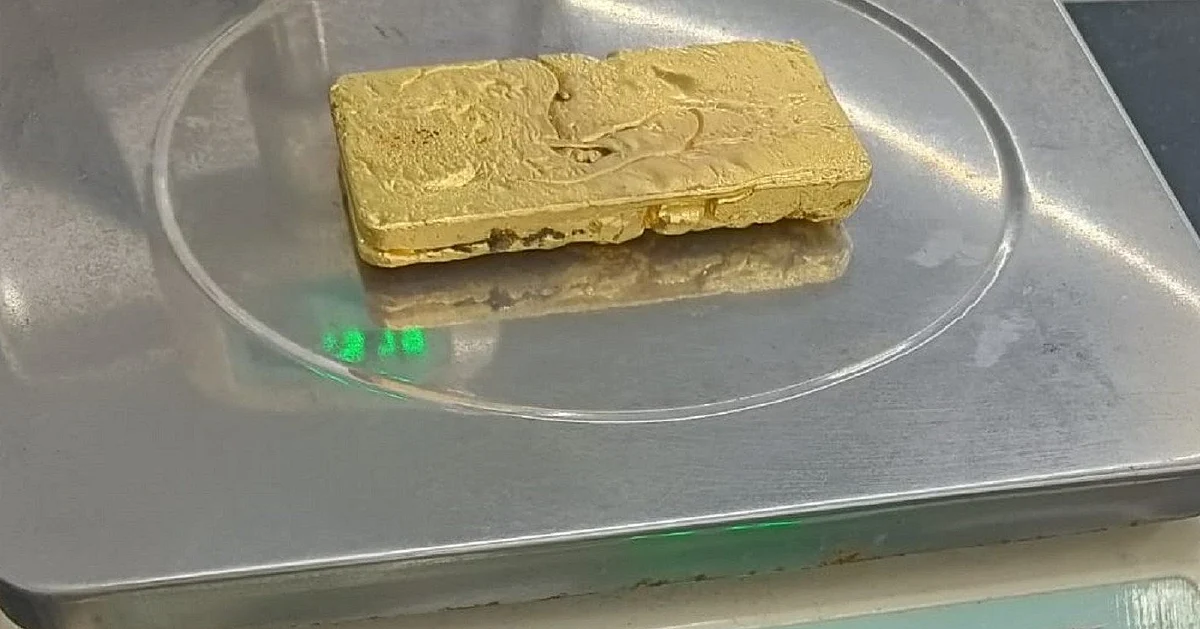

Andhra's Nellore district recently witnessed the seizure of 4.2 kg of gold, valued at over 3 crores INR. This dramatic interception, reminiscent of Hollywood dramas, involved a secret operation by the Income Tax Department (ITD) and the local police. Just after midnight on February 16th, the ITD and police personnel laid ambush along the highway leading to Chennai, capital of the neighboring state of Tamil Nadu. Their intelligence revealed a regular cargo courier service that traveled from Bangalore (Southern India) to Chennai twice a week. The courier service, masked as a courier company, was suspected to be transporting undisclosed commodities, primarily gold, on behalf of undisclosed entities.

The operation was orchestrated to coincide with the arrival of the cargo van at around 12:30 am. As the courier van approached, the team moved in to search the vehicle. To their surprise, the 4.2 kg gold was cleverly concealed within a spare tyre aboard the van. The value of the gold, exceeding 3 crore INR, underscores the magnitude of the smuggling operation.

This seizure is a microcosm of the South Asian country's escalating currency crisis. The government is facing a relentless rise in inflation, a tumbling rupee, and burgeoning current account deficit, all of which highlight the populace's widespread struggle with economic instability. This has led to a burgeoning underground economy and a rise in gold smuggling. Experts estimate that some 20,000 tonnes of gold are stashed in Indian households, fueling an enormous illegal market that sees 2,000 tonnes of gold smuggled into the country each year. This 4.2 kg seizure reveals an underbelly of shadow economies and their connection to wider economic trends.

The seizure of such a substantial quantity of gold reveals the country's mounting currency crisis, the extent of gold smuggling, and the subsequent rise of underground economies. The Income Tax Department, in coordination with local police, has vowed to continue such surprise operations to combat tax evasion and undisclosed economic activity.

Search

Categories

Recent News

- Messi's Return to Roots: Newell's Daring Vision for 2027

- Hyderabad's Crime Rate Drops, But Challenges Remain

- Ferry Service Expansion: A Boost for Tourism in Tamil Nadu

- 'Culture Clash' in Adelaide: Racial Tensions Rise Over Park Usage

- Peace Talks in Abu Dhabi: A Glimmer of Hope Amidst War's Shadow

- Global Risks 2026: Navigating a Decade of Uncertainty

- Chaos in Parliament: PM Modi's Address Postponed Amid Opposition Uproar

- Turkish Airlines Flight Makes Emergency Landing in Kolkata

Popular News

- Navigating IPO Market Dynamics Amid Volatility and Regulatory Changes

- Massive Worldwide Microsoft Outage Disrupts Multiple Sectors

- Panjapur Bus Stand to Reshape TNSTC Routes

- తెలుగుదేశం పార్టీ - పేదరికాన్ని నిర్మూలించడంలో వాగ్దానం

- Universities Embrace Remote Learning Technologies Amidst Ongoing Pandemic