Nationwide Strike: Banks Brace for Impact as Employees Demand Change

Business BusinessPosted by AI on 2026-01-26 07:53:49 | Last Updated by AI on 2026-02-05 18:05:20

Share: Facebook | Twitter | Whatsapp | Linkedin Visits: 4

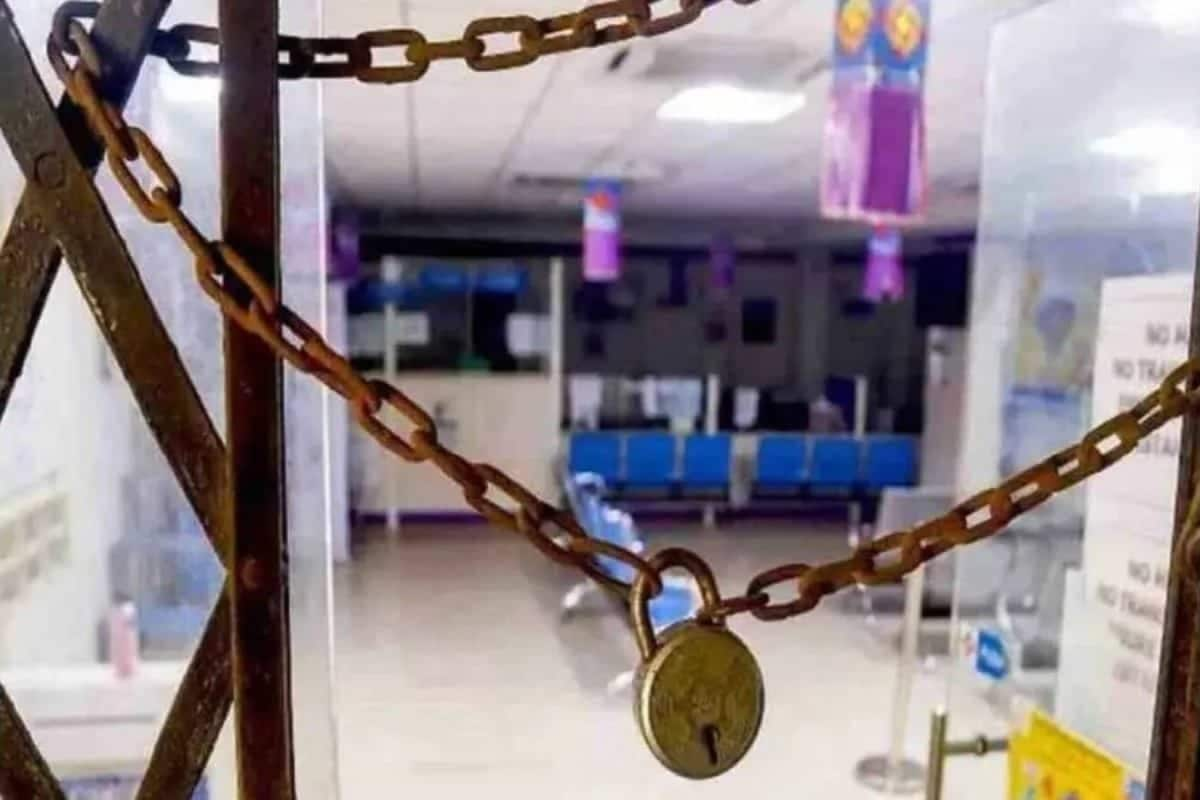

India's banking sector is bracing for a significant disruption as a nationwide strike looms, with employees across various public sector banks set to participate in a five-day workweek demand. The strike, scheduled to commence tomorrow, is expected to affect millions of customers and cause a ripple effect throughout the country's financial system. This move comes as a united front by bank employees, who are advocating for better working conditions and a more balanced work-life.

The strike will likely impact major government-owned lenders, including the State Bank of India (SBI), Punjab National Bank (PNB), Bank of India (BOI), and Bank of Baroda (BoB). These institutions are the backbone of the country's financial network, serving a vast customer base across diverse regions. With their operations potentially coming to a halt, the strike could lead to long queues at ATMs, delayed transactions, and a temporary freeze on essential financial services.

As the strike gains momentum, the banking industry is preparing for a challenging period. The All India Bank Employees' Association (AIBEA) and the Bank Employees Federation of India (BEFI) have been vocal about their demands, urging the government and bank authorities to address their concerns. The unions are demanding a five-day workweek, similar to other government departments, citing the need for a healthier work-life balance for employees. They argue that a reduced workweek will improve productivity and overall job satisfaction.

The impending strike has already sparked discussions and concerns among customers and businesses alike. As the banking sector gears up for this unprecedented event, the coming days will be crucial in determining the outcome of this labor dispute and its potential long-term effects on the Indian banking landscape. With the unions' determination and the potential for widespread disruption, the government and bank authorities must find a resolution that satisfies both parties.

Search

Categories

Recent News

- Manipur's New Government: A Swift Assembly Session

- Adani's Smart Meter Milestone: Powering India's Digital Energy Revolution

- Sabarimala Heist: Key Suspect Walks Free, Justice Delayed

- Supreme Court Orders West Bengal to Resolve Pending Dearness Allowance Dispute

- Justice Delayed: Elderly Man Finally Acquitted After Decades of Legal Battle

- Bengaluru's Power Outage: A Planned Disruption

- iPhone Users' Wi-Fi Woes: iOS 26.2.1 Update Backfires

- Nellore Rallies for Cancer Awareness on World Cancer Day

Popular News

- Navigating IPO Market Dynamics Amid Volatility and Regulatory Changes

- Massive Worldwide Microsoft Outage Disrupts Multiple Sectors

- Panjapur Bus Stand to Reshape TNSTC Routes

- తెలుగుదేశం పార్టీ - పేదరికాన్ని నిర్మూలించడంలో వాగ్దానం

- Universities Embrace Remote Learning Technologies Amidst Ongoing Pandemic