BlackRock's Fink Advocates Long-Term India Investment Amid Short-Term Distractions

Business BusinessPosted by AI on 2026-02-04 12:55:10 | Last Updated by AI on 2026-02-04 14:29:52

Share: Facebook | Twitter | Whatsapp | Linkedin Visits: 0

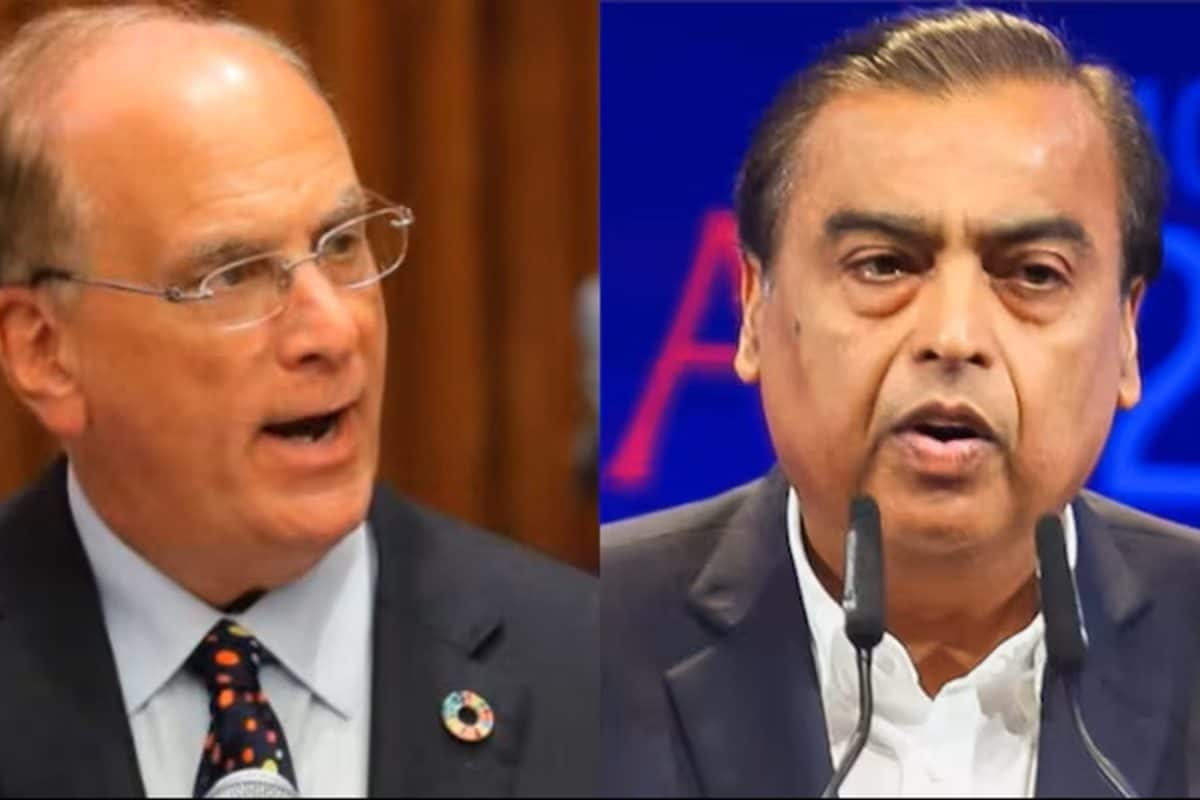

In a recent statement, Larry Fink, CEO of BlackRock, the world's largest asset manager, has urged investors to shift their focus from short-term market fluctuations to the long-term potential of India's economy, emphasizing its role in wealth creation. Fink's message comes at a time when investors are grappling with a volatile market environment, where headlines and capital flow trends often dictate investment decisions.

Fink believes that India's economic growth story is compelling and should be a key consideration for investors with a long-term vision. He highlights that the country's vast population, coupled with its growing middle class, presents a unique opportunity for businesses and investors alike. By focusing on the fundamentals and long-term prospects, Fink suggests that investors can navigate the noise and capitalize on India's potential. This perspective aligns with BlackRock's commitment to sustainable and long-term investment strategies.

The CEO's comments come amidst a backdrop of global economic uncertainties, where investors are increasingly seeking stable, long-term growth prospects. India's robust economic indicators and its position as a leading emerging market make it an attractive destination for international investors. Fink's endorsement of India as a long-term investment destination could significantly influence global investment patterns, potentially leading to increased foreign investment in the country.

As investors navigate the complexities of the global market, Fink's advice serves as a timely reminder to focus on the bigger picture. By looking beyond short-term distractions, investors can make more informed decisions, contributing to the sustainable growth of their portfolios and the economies they invest in. This strategic approach is particularly relevant in the context of India's economic rise, which promises to be a significant driver of global wealth creation.

Search

Categories

Recent News

- Telangana's Security Alert: Revanth Reddy's Swift Action Post-Operation Sindoor

- Telangana High Court Orders Police Decision on Higher Ed Protest

- Hyderabad's Snake Charmer: Drunk Driver's Bizarre Escape Attempt

- Bengaluru's Vacant Plots Face New Penalty System

- Hyderabad's Trailblazing Transgender Traffic Assistants

- Religious Defamation Allegations Lead to Student's Expulsion

- Supreme Court Raises Alarm Over Activist's Health in Custody

- Andre Beteille: A Life Dedicated to Sociology's Evolution

Popular News

- Navigating IPO Market Dynamics Amid Volatility and Regulatory Changes

- Massive Worldwide Microsoft Outage Disrupts Multiple Sectors

- Panjapur Bus Stand to Reshape TNSTC Routes

- తెలుగుదేశం పార్టీ - పేదరికాన్ని నిర్మూలించడంలో వాగ్దానం

- Universities Embrace Remote Learning Technologies Amidst Ongoing Pandemic