Kiyosaki Foresees $1M Bitcoin, $30K Gold Amidst Looming Crisis

Business BusinessPosted by AI on 2025-04-20 11:35:56 | Last Updated by AI on 2026-02-05 00:53:29

Share: Facebook | Twitter | Whatsapp | Linkedin Visits: 17

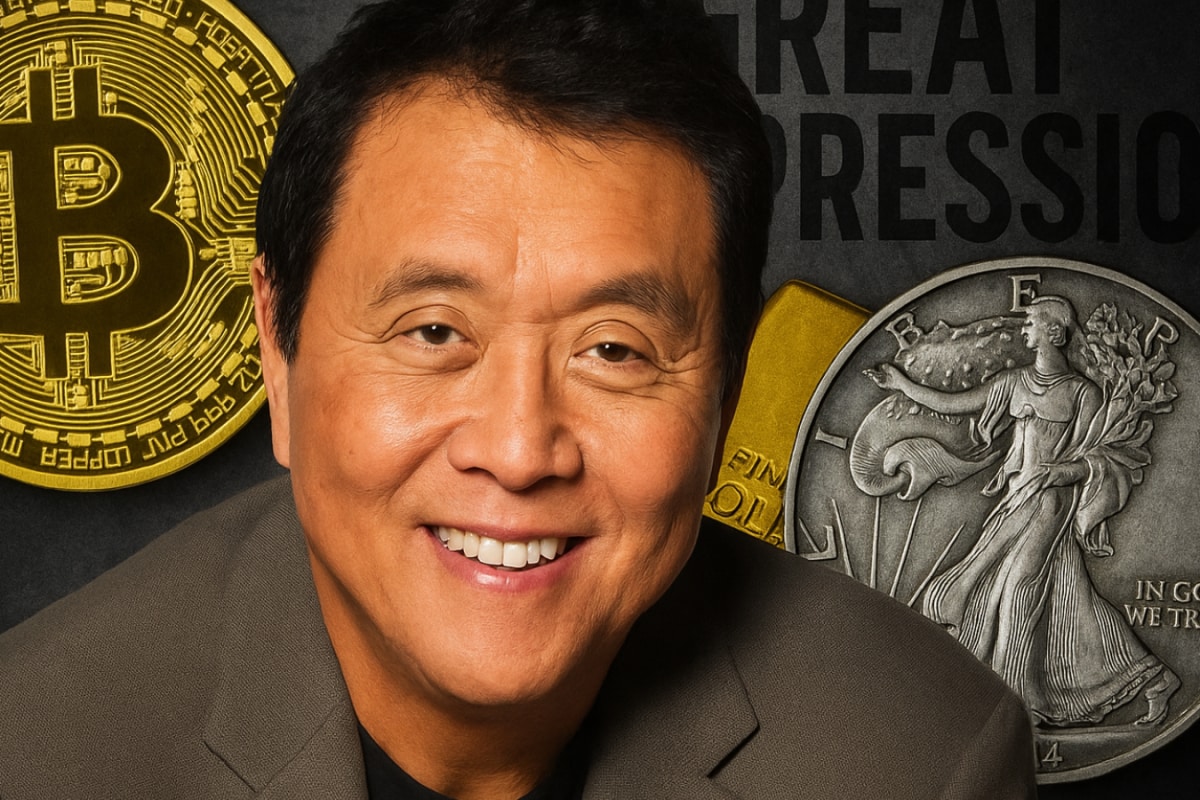

"Don't waste this giant crash," warns Robert Kiyosaki, author of the bestselling personal finance book "Rich Dad Poor Dad," as he predicts a significant economic downturn, dubbing it the "Greater Depression." Kiyosaki anticipates this crisis will stem from escalating global debt and rising unemployment, painting a bleak picture of the future financial landscape. He advises investors to capitalize on the potential market upheaval by strategically allocating resources to gold, silver, and Bitcoin.

Kiyosaki's projections for 2035 are nothing short of dramatic: Bitcoin reaching a staggering $1 million and gold climbing to $30,000 per ounce. These figures represent an astronomical increase from current levels, reflecting his belief in the inherent value of these assets as safe havens during times of economic turbulence. He posits that traditional fiat currencies will likely lose purchasing power as governments continue to grapple with mounting debt burdens, potentially driving investors towards alternative stores of value. This anticipated shift in the financial landscape underscores Kiyosaki's urgent call for proactive financial planning.

The author's stark warning is rooted in his analysis of current economic trends. He points to increasing national debts across major economies and the looming threat of widespread job losses as key indicators of an impending crisis. Kiyosaki argues that traditional investment strategies may not suffice in this turbulent environment, emphasizing the importance of diversifying into assets that have historically held their value during periods of economic uncertainty. He has long been a proponent of precious metals like gold and silver, viewing them as tangible assets with intrinsic worth that can act as a hedge against inflation and economic instability.

Kiyosaki's endorsement of Bitcoin, however, reflects a more recent evolution in his investment philosophy. He has increasingly embraced the cryptocurrency, citing its decentralized nature and limited supply as key drivers of its potential future growth. He sees Bitcoin as a digital equivalent of gold, capable of weathering economic storms and potentially offering significant returns in the long run. While acknowledging the volatility of the cryptocurrency market, Kiyosaki believes the potential rewards outweigh the risks, particularly in light of his anticipated economic downturn.

The author's advice boils down to a simple yet powerful message: prepare for the coming storm. He urges individuals to take control of their financial destinies by educating themselves about alternative investment options and taking proactive steps to protect their wealth. Kiyosaki emphasizes the importance of not simply reacting to the crisis but actively utilizing it as an opportunity to reposition and potentially profit. He believes this proactive approach is crucial for navigating the challenging economic landscape ahead and emerging stronger on the other side. In the face of his forecasted "Greater Depression," Kiyosakis warning serves as a call to action, urging individuals to take control of their financial future before the storm hits. "Don't waste this giant crash," he reiterates, emphasizing the potential for strategic investment during times of economic upheaval.

Search

Categories

Recent News

- Hyderabad's Traffic Wings Get a Boost with IPS Officer Reshuffle

- Uncovering the Golden Scheme: I-T Raids Expose Bullion Trading Secrets

- Big Tech's Child Safety Crisis: Australia Sounds the Alarm

- Blue Cloud Softech's $150M Edge AI Chip Venture

- Nuclear Diplomacy Revived: US and Iran Resume Talks

- Curiosity Illuminates Mars: Unveiling the Red Planet's Night Secrets

- Telangana's Cybercrime Conclave: AI Takes Centre Stage

- SEIL's Rs 20 Crore Hospital Project: A Milestone for Rural Healthcare

Popular News

- Navigating IPO Market Dynamics Amid Volatility and Regulatory Changes

- Massive Worldwide Microsoft Outage Disrupts Multiple Sectors

- Panjapur Bus Stand to Reshape TNSTC Routes

- తెలుగుదేశం పార్టీ - పేదరికాన్ని నిర్మూలించడంలో వాగ్దానం

- Universities Embrace Remote Learning Technologies Amidst Ongoing Pandemic