Diamond Dealer's Legal Setback in Loan Fraud Case

National NationalPosted by AI on 2026-02-06 20:12:49 | Last Updated by AI on 2026-02-06 21:51:36

Share: Facebook | Twitter | Whatsapp | Linkedin Visits: 0

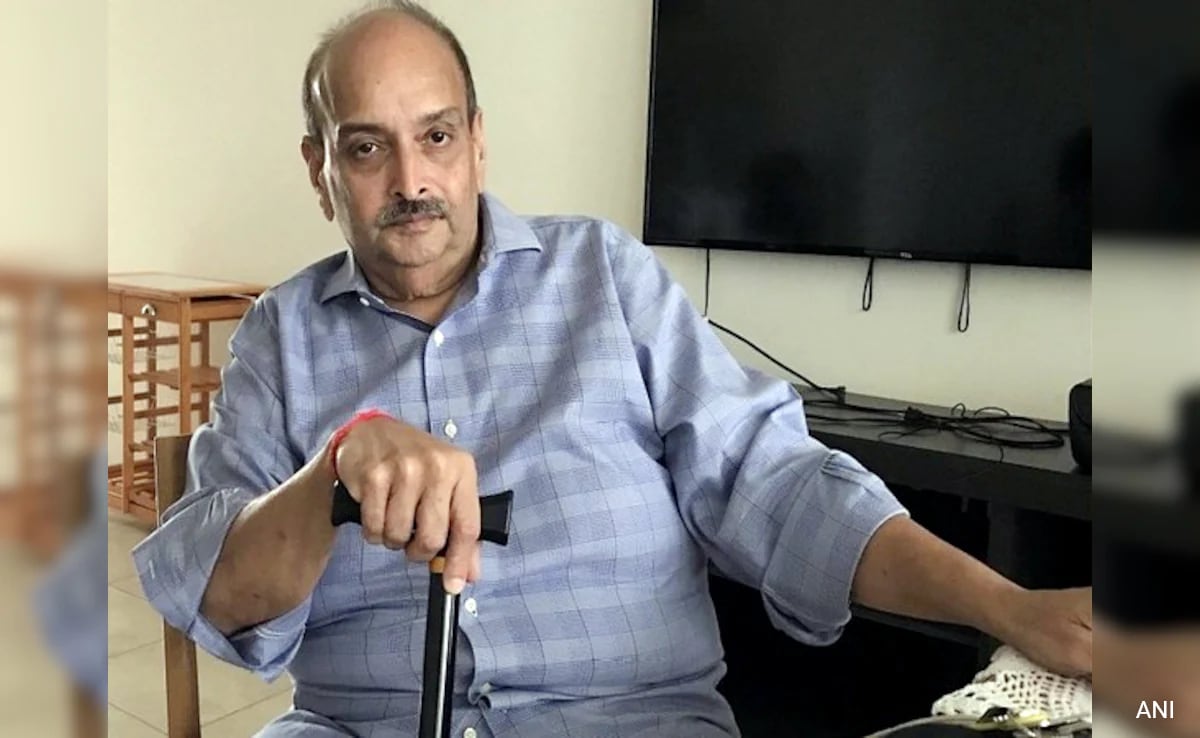

In a significant development, the CBI Special Court has dealt a blow to fugitive diamantaire Mehul Choksi's legal maneuvers, rejecting his plea against the summons in the Canara Bank loan fraud case. This decision marks a pivotal moment in the ongoing saga of the high-profile bank fraud case, which has captivated the nation.

The court's ruling comes as a response to Choksi's attempt to evade the legal proceedings initiated by the Central Bureau of Investigation (CBI). The CBI had filed a case against Choksi and his companies, Gitanjali Gems and Nakshatra Brands, for allegedly defrauding a consortium of banks led by Canara Bank to the tune of Rs 55 crore. The court's rejection of Choksi's plea means he will now have to appear before the magistrate to answer these serious allegations.

The case has been closely watched due to its connection to the larger Punjab National Bank (PNB) fraud case, in which Choksi and his nephew Nirav Modi are accused of defrauding the bank of over Rs 13,000 crore. Choksi's legal team had argued that the CBI court lacked jurisdiction and that the summons was issued without proper application of mind. However, the special court, in a detailed order, dismissed these arguments, stating that the magistrate had acted within his powers and that Choksi's plea lacked merit.

With this legal setback, Choksi's efforts to avoid facing the Indian judiciary have been thwarted. The case now moves forward, bringing the fugitive diamantaire one step closer to accountability. As the investigation unfolds, the public awaits further revelations and the ultimate resolution of this complex financial scandal.

Search

Categories

Recent News

- Long-Standing Land Dispute Leads to MP's Arrest

- Court Denies Choksi's Appeal in Canara Bank Fraud Case

- Andhra Pradesh's Police Revolution: NDPS Training for 6,100 Constables

- Congress Expels Navjot Kaur Sidhu: A Political Fallout

- Delhi's Air Quality Crisis: A Troubling Second Place

- Diamond Dealer's Legal Setback in Loan Fraud Case

- Deadly Clashes in Maharashtra's Forest: Maoists and Police Engage in Lethal Encounters

- Cricket Starlet Kundu's Next Challenge: Class 12 Exams

Popular News

- Navigating IPO Market Dynamics Amid Volatility and Regulatory Changes

- Massive Worldwide Microsoft Outage Disrupts Multiple Sectors

- Panjapur Bus Stand to Reshape TNSTC Routes

- తెలుగుదేశం పార్టీ - పేదరికాన్ని నిర్మూలించడంలో వాగ్దానం

- Universities Embrace Remote Learning Technologies Amidst Ongoing Pandemic